hpo Spotlight

Successfully overcoming economic crisis

The current economic downturn is posing significant challenges for manycompanies. The road back to the pre-crisis level will likely take longer thanexpected. But how? Create competitive advantages by adjusting the operating point and building a high performance organisation.

Share article

Adjust the operating point in the event of a slump in demand

The current downturn in demand has shown how sensitively the economic system reacts and how thin the line is between a functioning and non-functioning company. In contrast to previous crises, such as after the Lehmann crisis in 2009, the forecasts indicate only slow recovery and that demand will develop at a lower level than before the crisis.

How can companies deal with this situation? It is helpful to take a closer look at the so-called operating point of a company. This operating point indicates how many resources are needed to generate a defined output. The operating point can also be regarded as “company efficiency.” Practical experience shows that companies cannot scale arbitrarily along the so-called “efficiency gradient” – a prerequisite would be total flexibility in resource use. Companies can usually handle a change in demand of only around 10% without significant efficiency loss.

There are three typical strategies, each of which is based on differently anticipated demand developments

- The scaling strategy:The downturn in demand is limited in time and number; the operating point shifts on the previous efficiency line ( a) within a few percentage points. A return to the original operating point is possible but unnecessary because the organisation also functions in the “new operating point”.

The bridging strategy: The demand recovers briefly, and this period is bridged with resource reduction or short-time work. During this bridging phase, the company is willing to operate at a less favorable operating point. In the graph, this corresponds to operating point b on the efficiency line b.

Realignment strategy: The company expects no or a very long-term recovery in demand. The company temporarily creates its own breathing space and secures its operations by resource reduction and/or short-time work (operating point b). In contrast to the bridging strategy, the company imitates an improvement in efficiency through appropriate measures and transforms the company from operating point b to c and further in direction d.

Looking at the emerging far-reaching changes in the economy, such as a realignment of value chains, increased competition, and changed customer and supplier behavior, a realignment strategy currently offers the greatest opportunities for many companies. Because regardless of how quickly the demand recovers: These companies will be more sustainable and in a better position than those that simply wait and see.

Fig. 1: Demand-oriented operating point development and crisis strategies

hpo Webcast: In search of the optimal operating point

For further explanation of Figure 1, see the hpo webcast (German only):

How does a company restore optimal performance during economic fluctuations? In search of a new operating point.

Corona is the trigger but not the cause of the current crisis

The current economic crisis is likely to be referred to as the corona crisis in history books. However, it had been foreseeable long before the pandemic that a significant downturn would occur.

This article provides answers to three questions by the forecasting specialists at hpo forecasting:

- What caused the current crisis, and how was it predictable independently of COVID-19?

- What are the effects of the crisis on the industry?

- What will happen to the real economy?

1. What caused the current crisis, and how was it predictable independently of COVID-19?

More than a year ago – at a time when the world was still unaware of the pandemic – the following facts pointed to an imminent, sharp economic downturn:

- Industrial and consumption cycle:The industrial cycle had already passed its peak in all major economic regions. The euphoric consumption in Europe and the USA was a typical sign indicating that the crash was not far off. In the last 50 years, there has always been a recession when retail sales and industrial production peaked together in the OECD, defined as the maximum deviation from long-term trend growth (see chart above).

Falling order volumes in the industry: Especially early-cyclical industries, such as the semiconductor industry, have recorded a sharp decline in incoming orders as of late 2018. This is an important early indicator for other, more late-cyclical industries.

Declining business confidence: The Business Confidence Index – also a reliable leading indicator for the industry – has been declining synchronously in the three major economic regions of Asia, Europe, and North America for several months.

Inverse interest curve: On 13 May 2019, the American interest rate curve turned negative. This means that US government bonds with a ten-year maturity bore lower interest rates than those with a threemonth maturity. In recent decades, this has always been a reliable indicator of an imminent recession in the USA.

We already highlighted these points more than a year ago in the Economic Commentary for the 2nd quarter of 2019, which can be found at www.hpoforecasting.ch/ publications. The signs showed that a crisis was imminent; all that was missing was the trigger. It is probably impossible to predict precisely this. We had not expected a pandemic either. Our “favorites” for the trigger at that time were rather political events like an escalating trade war, a hard Brexit, or a military conflict in Iran.

The lockdowns and the resulting uncertainty further intensified the downturn. This is why we regard COVID-19 as the trigger and also as the catalyst for the downturn in the real economy that would have occurred in 2020 anyway.

What are the effects of the crisis on the industry?

The long-term driver of the real economy is consumption. It slumped dramatically in Asia, Europe, and North America during the lockdown in the first half of the year. The sharpest decline was observed in China, which also took the longest to recover compared to Western countries. In our opinion, the very dynamic consumption in Europe and the USA over the summer is strongly related to compensatory effects from the lockdown and is not sustainable.

When comparing consumption in the 12 months from September 2019 to August 2020 with the same period in the previous year, it is noticeable that consumption in the USA fell by 1.4 %, in Europe by 3.6 %, and in China by as much as 10.8 %.

The development of industrial production shows a different picture. China’s lockdown-related downturn was only short-lived, and the industry’s momentum is already back above pre-crisis levels.

The downturn in Europe and the USA was comparable, although the recovery is much slower and the industry in the West is still well below pre-crisis levels. It also appears that the recovery process as a whole has come to a halt again, and the development is moving sideways at a low level (see next graph).

Comparing the industrial production of the last 12 months until August 2020 as a whole with the values of the same period of the previous year, we obtain the following results:

- Europe –6.2%

- USA –5.2%

- China –3.0%.

Fig. 2: Development of industrial production from September 2019 to August 2020 in Europe, USA and China in comparison. More recent data is not yet available

What will happen to the real economy?

The uncertainty remains high despite reports of success in the development of a vaccine against COVID-19. Unemployment is expected to increase in the coming months. Further lockdowns, such as those imposed in Europe this autumn, are also poison for the economy. The hpo model calculation continues to indicate a low level of dynamism for the coming year, although developments in individual sectors can be extremely volatile. As usual, the developments in the individual industrial sectors can vary greatly.

Order intake forecasts for the industry

hpo forecasting is specialized in the preparation of individual forecasts of incoming orders for industrial companies. The forecasts of hpo forecasting are based on the Peter Meier Forecasting Model, a scientifically sound and empirically tested model. The Swiss association of mechanical and electrical engineering industries (SWISSMEM) has obtained industry forecasts from hpo for over 20 years. Large companies such as TRUMPF or BOBST but also major SMEs use company-specific order intake forecasts. Using the forecast model, the last three major crises – the dot-com bubble in 2001, the financial crisis in 2008/2009, and also the current downturn – were each predicted with a lead time of about two years.

hpo forecasting is a sister company of hpo management consulting ag.

Josua Burkart

Geschäftsführer hpo forecasting ag

josua.burkart@hpo.ch

+41 41 461 00 22

Change old ways – or try something entirely new?

The answer is clear: Do the one and do not let the other be.

Since the beginning of the Corona crisis in spring 2020, it has become clear that the demand for individual products and services will probably remain reduced in the long-term. For example, this includes many travel-related matters, primarily air travel and associated services such as limousine services or travel agency services. Also affected are numerous industrial goods such as those in the automotive supplier sector. At the same time, there are products and services that are experiencing a marked increase in demand. These include, for example, disinfectants, hygiene masks, general hospital equipment, but also offers for video conferencing, homeschooling, or the entire field of research related to the cure of or vaccination against the COVID-19 virus.

Most companies cannot stop or at least significantly reduce the production or provision of existing products and services overnight and switch to a product area that will continue to enjoy great demand for the foreseeable future. Existing know-how, infrastructure (e.g., production facilities), customer and supplier relationships – all these factors are aligned with the existing product or service range. A switch to a new field of activity with high demand usually requires the development of new skills, new infrastructure, new customer and supplier relationships, and often an entirely new business model. In most cases, there is still some demand on the market for the services previously provided. But how they can still be provided profitably in the future is changing compared to the past: Demand is lower, supply chains are changing, and so are customer needs. This is why the current situation must be questioned as a matter of principle:

- Do we still occupy the right stage of the value chain in our industry?

- Does our value proposition meet the needs of existing (and potential) customers?

- Do we have the necessary high-performance business process model that efficiently generates our current products and services, even at reduced demand levels?

- And does our management structure correspond to this new way of providing services?

When questioning the current situation, it is inevitable that the question of new business areas with better prospects for demand arises – in extreme cases, this even leads to a significant shift away from existing business areas. Typical questions in this context are:

- What competencies do we have that can be applied in business areas with better growth opportunities?

- What does this mean for our value creation system?

- Are we set up to pursue innovations systematically?

- And how do we transform our organisation accordingly?

All these questions can be answered systematically and efficiently with strategic enterprise design.

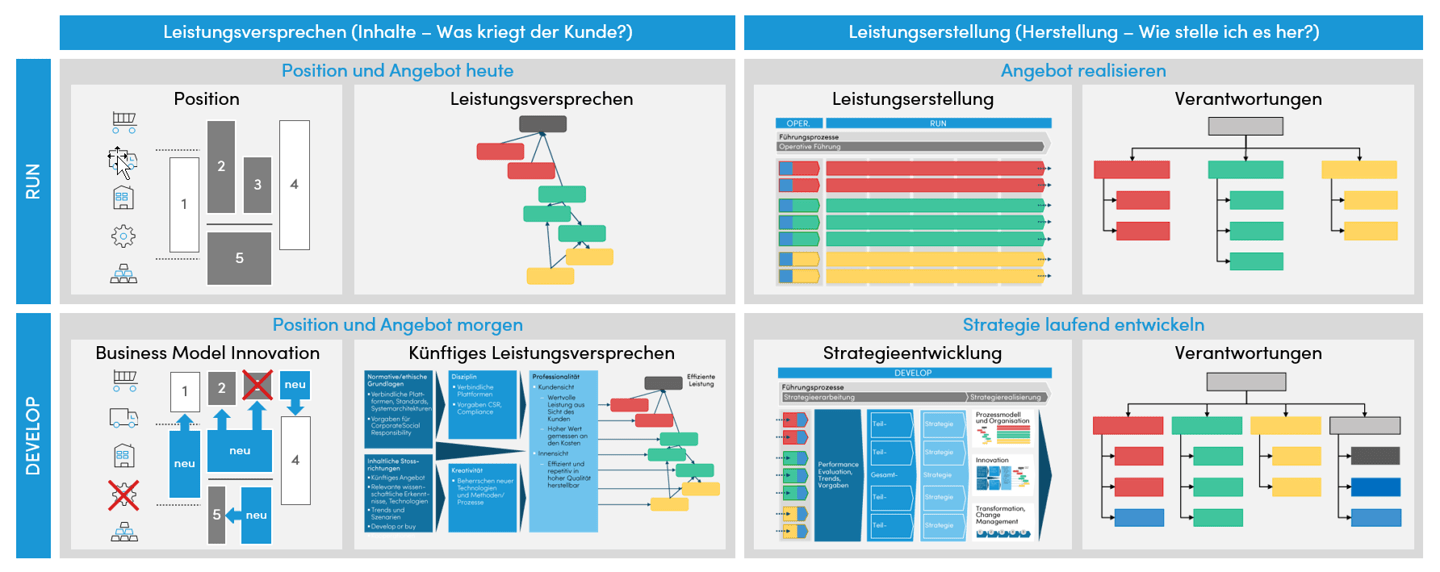

Strategic enterprise design to create a clear target image for the transformed organisation

The transformation of a company can only be successful if there is a clear picture of how the organisation should look and function in the future. Such a target image must answer a wide variety of questions. These can be divided into two main topics:

1. What will our “service provision” look like, i.e., how do we satisfy known needs of (target) customers with specific products and services generated by high-performance business processes in a process-based leadership structure?

Typical questions that need to be answered are: How is the company positioned in the market? Which value creation stages are being addressed? Which customer needs are satisfied, and what is the corresponding value proposition? What core competencies do we need for this? What is a business process model that most efficiently generates or procures the products and services required for this value proposition? What does this mean for the management structure - especially in larger and internationally active organisations? How can end-to-end responsibilities and clearly defined contact points between main processes be ensured?

2. What does our “innovation” look like, i.e., how do we systematically deal with changes in the market and with technologies, and continually adapt our “system for service provision” to new requirements?

Typical questions that need to be answered are: Which innovation areas differentiate our offer and are particularly critical for our customers? How can they influence today’s value proposition or the “architecture of our market performance”? How do we ensure that ideas for improvements and innovations can be systematically reviewed and agilely tested for their suitability for our organisation? What does this mean for our management structure?

Achieving the target image through strategic enterprise design

Strategic enterprise design is a scientifically based methodology for designing companies. It is about making the right (positioning) better (end-to-end responsible processes and an appropriate organisational structure). Enterprise design is the holistic view and design of a company (or a business unit, an institution, or a public authority) according to a clear design logic – from strategic positioning with clear market performance and the derived architecture of the offered products and services to the design of responsible processes, management structure, and empowerment of the organisation and employees. The enterprise design ensures that the company is successfully positioned and that the right strategic goals are achieved. Strategic enterprise design ensures that an enterprise can achieve its full performance (“high performance”), both at the planned “operating point” (measurable point for optimal performance) and in the event of deviations from the planned operating point, for example, caused by economic fluctuations. Strategic enterprise design enables flexibility and scalability. Business-critical elements are optimally coordinated, resulting in the highest possible level of performance – a high-performance organisation.

The steps towards a high-performance organisation

The strategic enterprise design looks at a company (or a business unit, an institution, a public authority) from a holistic perspective. It is like with a soccer team: It is no use having the best defense if the striker fails. Neither is it any use having good goalies if the defense fails with every enemy attack.

A well-coordinated team is more successful than a team with individual exceptional talents that are uncoordinated and do not have a good formation. It is just as crucial for a company’s success that its core business elements are perfectly coordinated, complement each other, and operate well together.

Enterprise design …

- defines the strategic positioning in which the company can operate successfully;

- identifies the corresponding services for which customers are willing to pay;

- reflects these services in responsible business processes and ensures a management structure with clear responsibilities;

- assigns a small number of directly influenceable KPIs to the processes, thus ensuring the measurement of the company’s performance and control;

- identifies strategic projects at an early stage;

- is the basis that all employees understand and support the goals and functioning of the company;

- ensures the goal-oriented and agile development of the organisation

... and thus leads to a long-term competitive high-performance organisation.

.

The core elements of strategic enterprise design

Based on the standpoint analysis results, the enterprise design can be focused on specific parts of a company

For example, if the assessment of the current situation shows that the strategic direction and the positioning are clear and meaningful, the company starts directly with the customer needs and the derived value proposition structure. Strategic enterprise design often first focuses on the area of service provision and addresses the area of innovation at a later stage. The approach of strategic enterprise design is very flexible. It can be adapted to a company’s situation, the urgency of changes, and the areas with the greatest leverage. What is fundamentally relevant in this respect is that all business-critical aspects are always kept in focus. This ensures that the effect on other elements is adequately considered when designing individual elements.

The design of a company’s service provision

(see the upper half of the chart: The core elements of strategic enterprise design)

- The clarification of the positioning shows which value creation the company should generate or in which direction it should develop. For this purpose, we use the industry model, which precisely depicts all relevant market participants with the corresponding interfaces and enables complex relationships to be discussed in a boardroom-suitable presentation.

- The value proposition and the range of services are structured based on necessary competencies and are 100% aligned with customer needs, eliminating services that do not add value. The value proposition is developed into a value proposition structure that shows where and with which connections differentiating customer benefits are generated—a kind of parts list of the value proposition.

- End-to-end responsible processes are created to provide these partial services. These E2E processes are supplemented by the primary contact points between the processes. This leads to a macro-level business process model, which describes organisations’ activities and the requirement profiles for management positions. Depending on requirements, these E2E processes are then further optimized in detail at the micro-level in a further step, which describes the activities of individual persons and the use of aids. This can be used to derive requirement profiles for individual employees and specifications for ERP systems, robots, etc.

- Based on this model, objectively and comprehensibly develop the future-oriented organisation, including the corresponding responsibilities and role profiles. The hpo design principles require that end-to-end responsible processes are designed indivisibly in one management area. In this process, we are guided by the question: Which processes have the greatest benefit if they are combined into a common, higher-level management area? Or in other words: “It is not bosses looking for management areas, but processes looking for common bosses.”

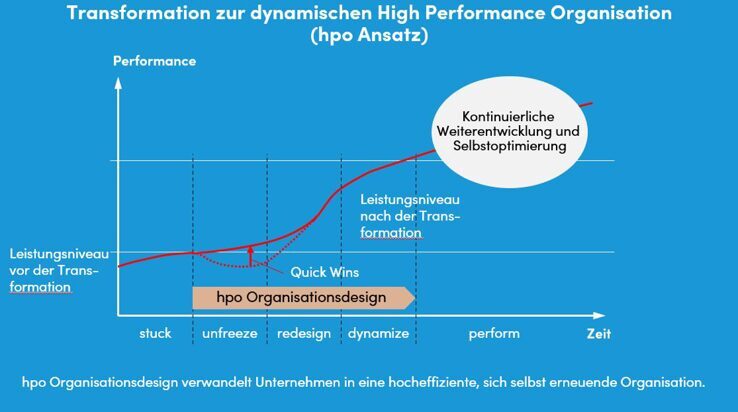

Transformation as a success factor

Two prerequisites must be met for the success of a transformation process:

1. clear target picture

There is a clear target picture of what the company should look like after the transformation. The path to this goal is outlined. The path and the goal cannot be considered independently of each other: the way in which the target image is "created" already has a great influence on whether a transformation is successful (or not). At the same time, the target image alone is not sufficient for a successful transformation. The timing of the individual transformation steps - adapted to the individual situation of the company - as well as a meticulous implementation of the change steps are decisive for the success of a company transformation.

2. awareness of the transformation phases

In order to assess the opportunities and risks of a transformation, one must look at the individual phases of the process. In most cases, transformation is initiated by a symptom that needs to be addressed, such as a decline in profitability, an external change such as consolidation in the market, or some other critical situation. The overarching goal of any transformation is usually to secure the future, assume social responsibility and ensure corporate attractiveness.

We usually distinguish between five phases of transformation:

Five phases of the transformation process

- Stuck: The company or the organisation as a whole or in a sub-area is reaching its limits. Performance is impaired, which manifests itself in the symptoms described above.

- Unfreeze: The previous situation is questioned and broken up ("unfreeze"). Employees should be involved in the development of the desired target state so that the target picture has broad support. A structured process and a transparent method support management in this task. Special attention should be paid to the buy-in of key decision-makers.

- Redesign: Now the transition from the current state to the target state takes place. In this phase, there is inevitably a slump in performance. The sceptics speak up and there is a danger that the company will be caught between two stools. It is the task of management to demonstrate leadership, to repeatedly make the necessity of change visible and to communicate the vision/objective and the benefits of change in the context of the change story as well as the first "quick wins". Clear decisions, active stakeholder management and the role-appropriate inclusion of those affected in the process accelerate the process and promote acceptance of the change. Behavioural changes and cultural development are supported with appropriate measures and workshops. Regular impact and implementation controlling with the corresponding learnings increases adaptability and helps to keep the duration and severity of the performance slump as low as possible.

- Dynamize: Most of the work is done. Employees increasingly adopt the newly learned processes, roles, responsibilities and behaviours. The changes begin to manifest themselves in the culture, cooperation improves. The performance curve rises.

- Perform: The empowerment of the employees and thus the organisation during the redesign allows the company to further optimise itself from now on. The performance curve is now above the level before the transformation.

Your strategy and organisation consultancy

Who is hpo management consulting?

hpo stands for High Performance Organisations. As experts for strategy, business processes, organisation and transformation, we have been supporting nationally and globally active clients since 1995 in releasing performance potential and transforming strategies into measurable results. With our holistic and partnership-based enterprise desing approach, we reliably lead them to their goal: a consistently designed and sustainably effective High Performance Organisation - fit for the future and with a clear competitive advantage.

hpo - unlocking performance